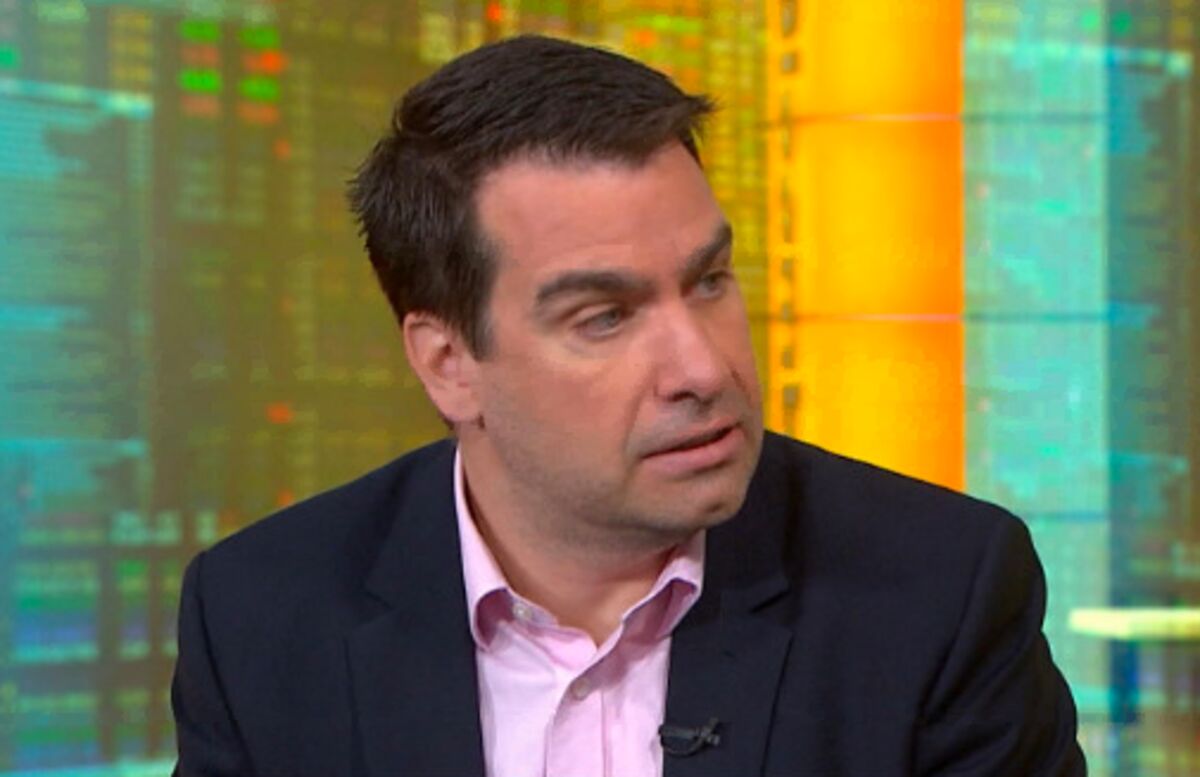

The last time we heard from JP Morgan uber-quant Marko Kolanovic was in early October when the world was full of fear. El analista de JP Morgan Marko Kolanovic considera que el problema de la inflación en los Estados Unidos tenderá a resolverse solo a medida que la Reserva Federal Fed se incline hacia un pivote y se desvanezcan las distorsiones en la economía causadas por la pandemia de coronavirus.

Jpmorgan S Kolanovic Says Peak Investor Hawkishness Is Now Over Bloomberg

JPMorgans Kolanovic Sees Three Reasons for More Stocks Upside - Bloomberg JPMorgans Kolanovic Sees Three Reasons for More Stocks Upside Strategist says hawkish Fed ECB are no reason to be.

. 1208 PM - 13 May 2021. At the time he said it was time to buy the dip because fears of higher. JPMorgans Marko Kolanovic Says Market Bubble Corrections Almost Over - Bloomberg JPMorgans Kolanovic Says Market Bubble Corrections Almost Over Strategist advises buying tech biotech and.

Marko Kolanovic JPMorgans chief global markets strategist said in a note on Tuesday that the recent pullback in areas like cyclical stocks names linked to overall economic growth and Treasury. Morgan markets analyst Marko Kolanovic explained his latest thinking in a note to investors as he sees the SP 500 rising to 3200. Covering the overall situation JPMorgan strategist Marko Kolanovic writes.

Yet despite latest revisions Kolanovic continues to recommend holding more stocks and fewer bonds than suggested by benchmarks to benefit from sustained economic growth. In addition volatility in stocks and rates is easing in a sign. Kolanovic expects the Fed to lift interest rates by a half percentage point on Wednesday.

Kolanovic who serves as the firms chief. Conforme vayan retrocediendo los altos niveles de. Marko Kolanovic Crystal Mercedes CNBC After a calm spring the stock market appears poised to push higher once again according to JPMorgans Marko Kolanovic.

Replying to jpmorgan SAFEMOON. Copy link to Tweet. Kolanovic points out that the SP 500 is on the cusp of breaking important momentum signals such as the 200-day moving average.

1 equity-linked strategist in last years Institutional Investor survey has stuck to his calls for risky assets this year despite the sharp. On stock charts the 200-day moving average is shown as a line. After six straight weeks of losses the US stock market is poised for a recovery as corporate earnings continue to grow JPMorgans quant guru Marko.

After a dramatic comeback in 2020. The SP 500 has largely traded below its. 150 oil wouldnt cripple economy or market JPMorgans Marko Kolanovic predicts oil is surging higher but so are stocks.

Julien herblot julien_herblot 13 May 2021. This view however differs from the thinking of JPMorgan Chief Executive Jamie Dimon who earlier Wednesday warned investors to prepare for an economic hurricane. Morgan Strategist Marko Kolanovic on tech trade inflation and the market outlook for 2021.

His stance diverges from JPMorgan economists led by chief US economist Michael Feroli who said they. We maintain that inflation will resolve on its own as distortions. JPMorgan Chase Cos Marko Kolanovic is quickly emerging as one of the very few bulls among Wall Streets top strategists who says US stocks will rally in the second half.

On stock charts the 200-day moving average is shown as a line. 6 Retweets 29 Likes 19 replies 6 retweets 29 likes. Kolanovic points out that the SP 500 is on the cusp of breaking important momentum signals such as the 200-day moving average.

Bloomberg -- Investors should modestly trim stock holdings and shift the money to commodities after equities outpaced other assets amid receding recession fears according to JPMorgan Chase Co. Markets have been ignoring weak economic data recently and even rallied over the past week according to JPMorgans Marko Kolanovic. JPMorgans Kolanovic says its time for investors to start adding back risk Published Thu Mar 17 20221238 PM EDT Maggie Fitzgerald mkmfitzgerald Share A trader works on the floor of the New York.

Kolanovic voted the No. Traders can use this line to determine whether the trend is up or down and identify potential support or resistance areas. Marco Kolanovic Professional Experience Academic History Professional Experience Head of Quantitative Research Head of Quantitative Research JP Morgan Chase Co Editor of Disruptive Profits Editor Disruputive Profits Senior Managing Director Managing Director 2005 - 2008 Bear Stearns Derivatives Strategist Strategist 2003 - 2005 Merrill Lynch.

150 Oil Won T Shut Down Economy Market Jp Morgan S Marko Kolanovic World Time Todays

Jpm S Marko Kolanovic On Where Stocks Are Headed Into The Otosection

Jpmorgan S Kolanovic Us Stocks Can Improve As Inflation Likely Peaked Bloomberg

Marko Kolanovic Kkolanovic Twitter

Borsen Befreiungsschlag J P Morgan Sieht Hoffnung Fur Den S P 500 Markte 20 05 2022 Institutional Money

Marko Kolanovic Best Sale 53 Off Www Ingeniovirtual Com

Wer Hat Recht Jpmorgan Bullisher Analyst Kolanovic Gegen Seinen Bearishen Chef Jamie Dimon 02 06 2022

Marco Kolanovic Head Of Quantitative Research Jp Morgan Chase Co

Why Markets Are Shrugging Off A Mild Recession Jpmorgan S Kolanovic

Marko Kolanovic New York New York United States Professional Profile Linkedin

Jpmorgan Quant Guru Marko Kolanovic Accuses Peers Of Political Bias Report

Jpmorgan Strategist Marko Kolanovic Warns Of Liquidity Cracks Remains Cautious On Bitcoin

Why The S P 500 Can Hit 3000 Barron S

We Think The Sell Off Is A Little Over Overdone At This Point Says Jpmorgan S Kolanovic Youtube

Marko Kolanovic Deals 58 Off Www Ingeniovirtual Com

Jpmorgan S Marko Kolanovic Predicts Stocks Will Reclaim 2022 Highs

J P Morgan On Twitter J P Morgan Strategist Marko Kolanovic On Tech Trade Inflation And The Market Outlook For 2021 Twitter

Jpm S Marko Kolanovic On Where Stocks Are Headed Into The Otosection